Your recurring bills, including rent, insurance, mobile devices, utilities, credit cards, etc. Enter your recurring income and expenses to see where your money goes each month.

#MONEY MANAGER EX ADD NEW BUDGET CATEGORY HOW TO#

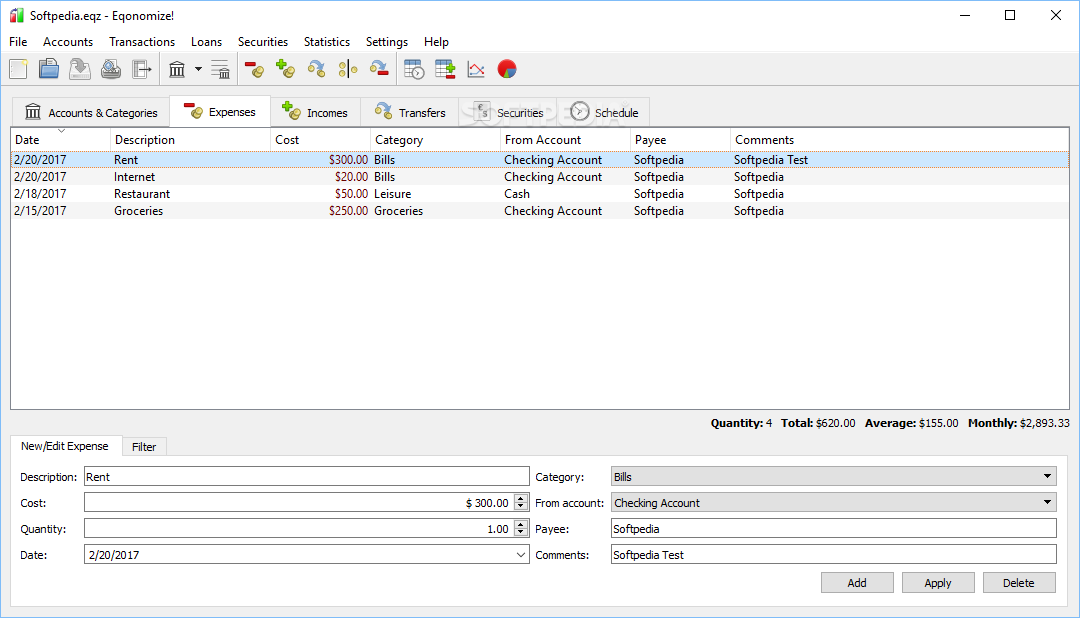

You will need to consult the many Help menus to determine what is automatic and not, and how to make it so in the easiest way possible.Īlthough AceMoney Lite enjoys all of the features of the nonlite AceMoney, its disadvantage is that it is truly "lite" in that you can only manage one account. Understanding your expenses is an important step in your financial journey, and our Monthly Budget Worksheet makes the process simple. Operating Money Manager Ex resembles working with more advanced. Copy the formula down to all rows of data. Money Manager Ex allows you to track expenses and set a budget for a specific time.

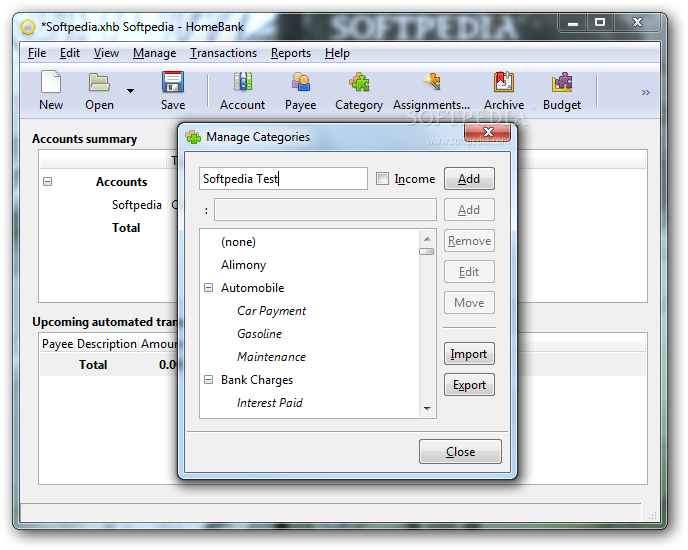

Enter the month () formula in the Month column. And if you enter an expense and find that none of the existing categories or subcategories fits your need, you can add a new one immediately (rather than. 2) for the month, which is handy when you have several months of data. (You can also name your own category, which seems to work best if you just edit the name of an existing category you don't plan to ever need instead of trying to figure out how to set a completely new category.) In some cases, you will automatically be taken to Yahoo Finance for information, where the information may or may not automatically repopulate your field in AceMoney Lite. A personal budget (for the budget of one person) or household budget (for the budget of one or more person living in the same dwelling) is a plan for the. 1) for spending categories, I used Type as the column heading. Once your account is set, you can manage your budget and set up categories from a very long list of possibilities, which is helpful for reporting how you are saving or spending money. To begin, just open the application, click on the account button for your one account, and provide all of the particulars as prompted. The program has an eye-friendly interface that is also fairly intuitive to use. With AceMoney Lite, one can easily organize and track spending, build budgets, track investment performance, set up payment reminders and recurring bill payments, create reports and pie charts, and so much more, for free.

0 kommentar(er)

0 kommentar(er)